UK Point of Sale Finance now worth over £4bn per year

Posted on in Business News , Cycles News

Around 7,000 UK high-street and online retailers now use retail finance, with 0% deals being increasingly common, says Apex Insight's report.

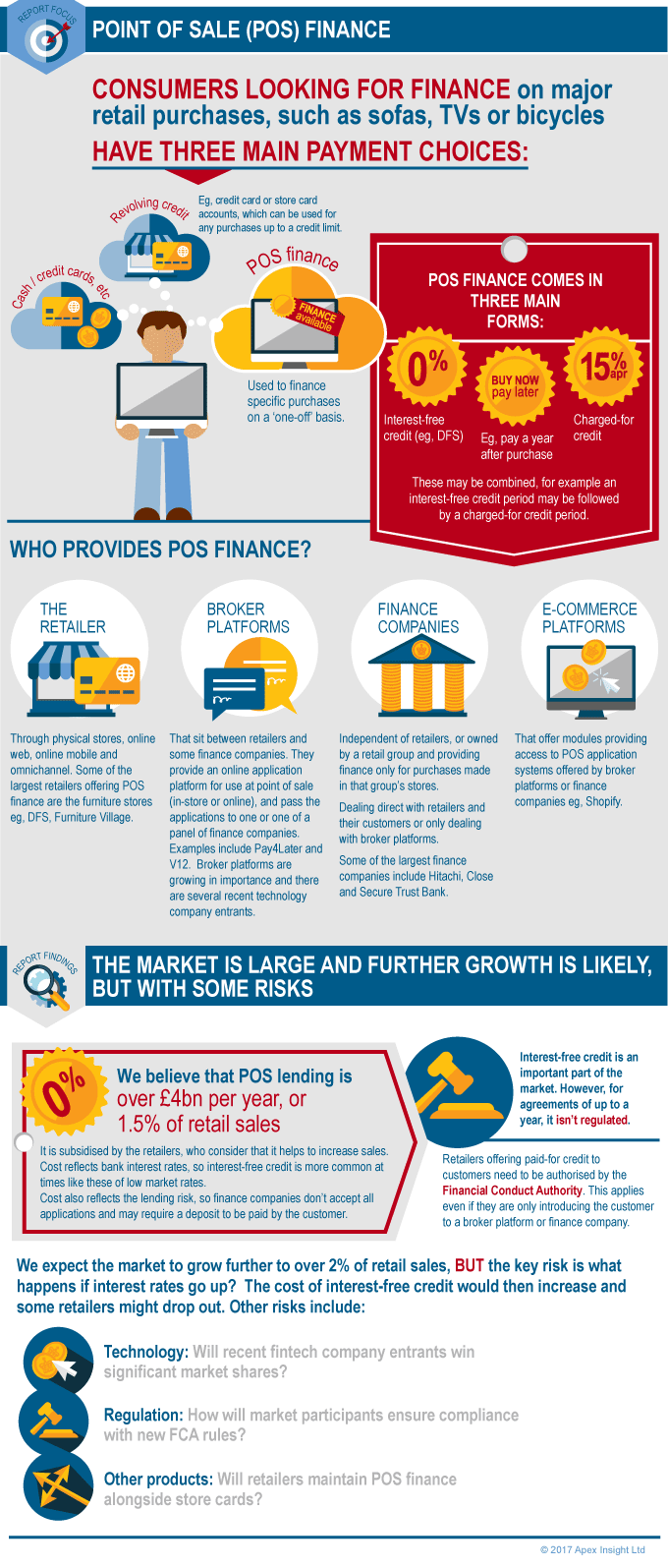

According to Apex Insight‘s latest report, lending via retail finance is thought to be worth over £4bn per year, equivalent to 1.5% of all retail sales in the UK. The report predicts that this market is set to grow further, to over 2% of retail sales.

The report identifies the key drivers of growth for POS Finance in recent years, as well as how the market works, recent happenings, threats, opportunities, the types of retailer it is favoured by, as well as comparisons with other forms of finance.

According to the report growth has been driven by trends, including the shift to online shops where finance deals are now very common and the widespread availability of interest-free deals and new technology such as apps enabling quicker decision-making and higher acceptance rates.

A breakdown of the report's findings on retail finance have been illustrated in the infographic below (click for full view).

Thinking of offering retail finance?

Ride it away retail finance is exclusively available to ACT members* and gives you access to:

Preferential rates

Preferential rates- No setup fee - save £495

- No monthly fees

- Payment released to you same day and in your bank within 4 days

- No minimum finance turnover requirement

- National consumer promotion via Ride it away

- Interest free and interest bearing APRs

- Quick and simple paperless online application process for in-store, online or mail order requests

- Exceptional acceptance rates

- Support throughout FCA application process

- Can be integrated into existing online sales options

- Dedicated customer service and personal account manager

- FCA compliant POS available

If you are not already offering retail finance or think you could be doing more sales via the scheme, click here or contact us today to find out more.

*Ride it away is exclusively available to members of the ACT. Subject to terms and conditions, including but not limited to, a minimum 12 month trading history, the business declaring a positive net worth and the search results of credit reference agencies