Your route to the right finance provider

Posted on in Business News , Cycles News

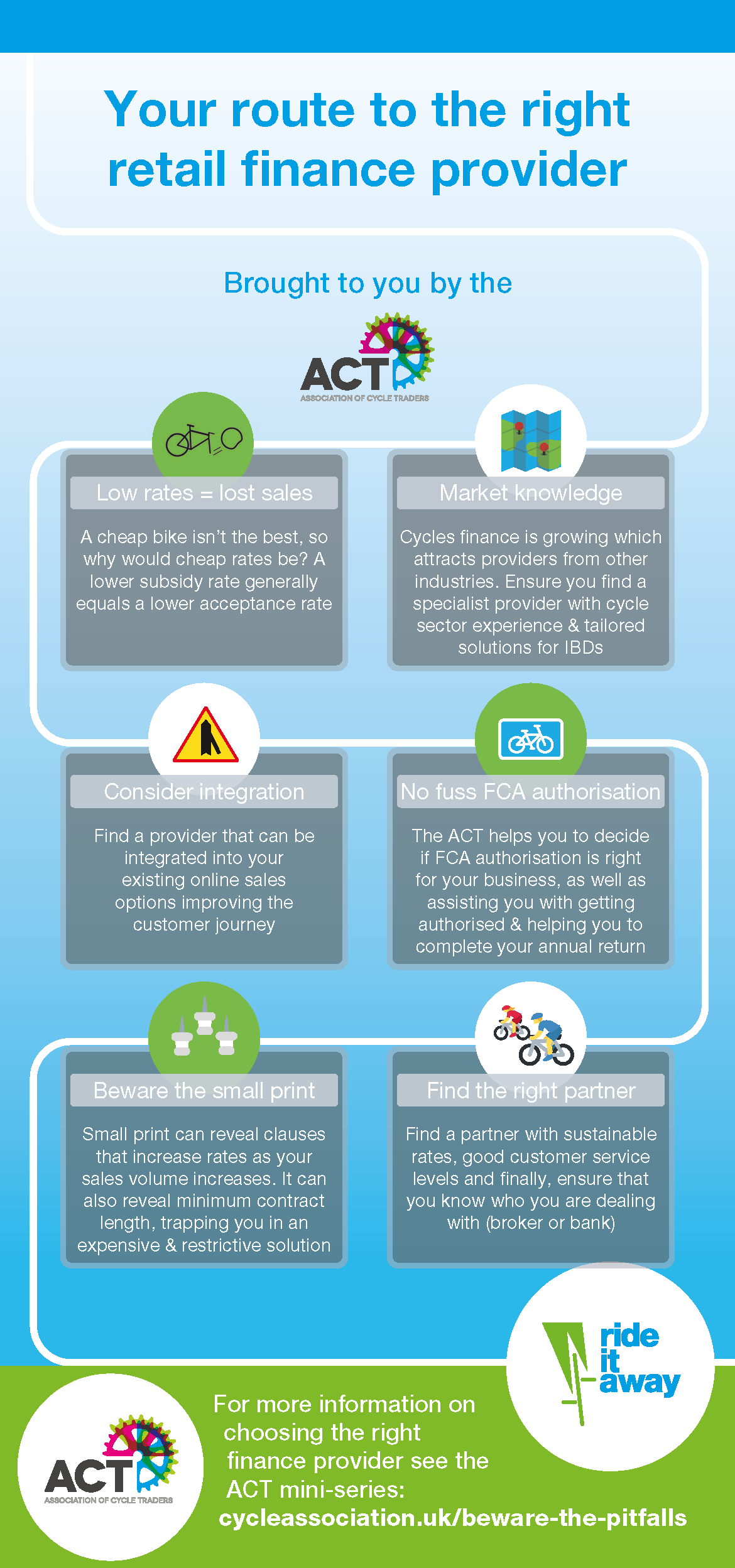

Following on from the ACT mini-series, Choosing the right finance provider, avoid the pitfalls, the Association of Cycle Traders have created an infographic to make it as clear as possible what to look out for when choosing the right finance provider for you.

Following on from the ACT mini-series, Choosing the right finance provider, avoid the pitfalls, the Association of Cycle Traders have created an infographic to make it as clear as possible what to look out for when choosing the right finance provider for you.

We know that more customers are spending using retail finance as the latest figures from the Finance and Leasing Association (FLA) identify that UK consumers now spend nearly £800 million every month on goods and services using retail credit.

The cycle retail finance landscape is currently experiencing many changes; providers consolidating, a lack of funds meaning providers have had to close and providers withdrawing from the market. Some of these scenarios have left cycle businesses high and dry.

This issue is being increasingly reported on by the media, with reports of Buy Now Pay Later services encouraging snap buys and causing consumers to become financially over-committed, these companies have also been accused of misleading customers and negatively affecting credit scores.

To avoid these pitfalls the ACT have provided a number of warning signs to look out for and steps to follow to ensure that you and your customers are being looked after during the retail finance process, as well as getting the best value for money.

If you have any questions about the points above, or you would like more information about Ride it away retail finance contact the ACT or visit the website.