The 5 fastest growing indie retail categories

Posted on in Business News , Cycles News

Recent research has been conducted by the Local Data Company to determine how the British high street is evolving with indie retailers at the helm.

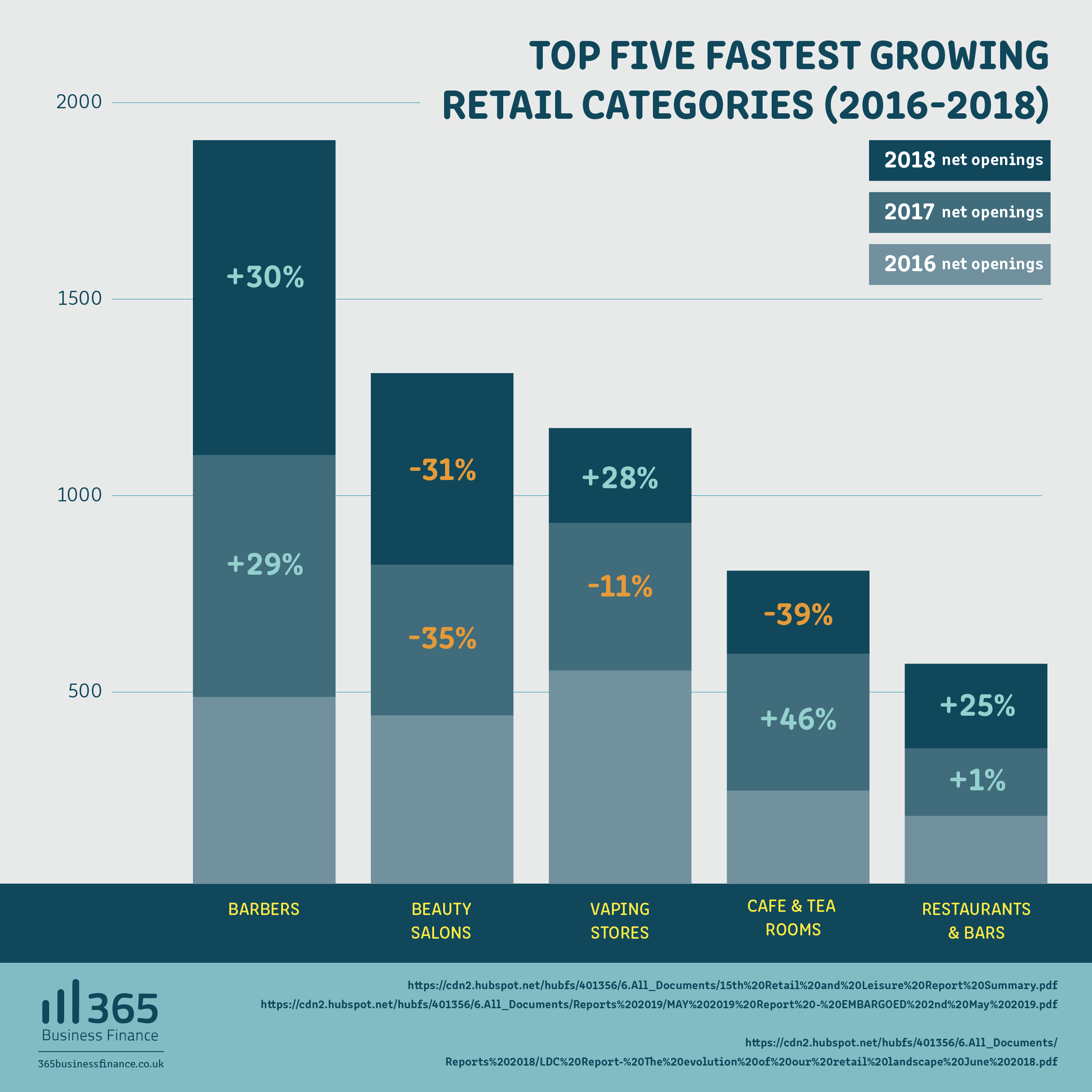

Key findings of the research showed that barbers, beauty salons, vape stores, cafes and tearooms, along with restaurants and bars have been the fastest growing retail sectors in the UK during 2016 to 2018, as they consistently experienced the highest number of net store openings during these years.

To put this information into context, London-based financier 365 Business Finance has created Recovery Road - a virtual high street that demonstrates the changing face of the retail industry in the UK.

365 Business Finance aims to keep Britain's high street alive through supporting small to medium sized businesses and providing cash merchant advances to independent retailers, the company is now celebrating it's five year anniversary. 365 Business Finance have reviewed the figures regarding the five fastest growing retail categories in an attempt to explain why they have taken a foothold despite the difficult climate.

Recovery Road acts as an interactive guide, showing how British retail and the high street has the potential to evolve with independent businesses at the helm.

Key Recovery Road stats include:

● The number of clean shaven men has fallen almost 20% in the last five years, which might explain why barber shops have been the number one fastest growing category for all three years.

● The 31,107 beauty salons that currently operate in the UK have witnessed a 28% increase in salon openings since 2017. Additionally, Londoners spend an average of £470 per month compared to a national average of just over £96.

● Although vape stores have experienced a 35% decrease in the net number of units opened between 2017 and 2018, they were still the third fastest growing category in 2018. This comes at a time when 48% of people who use an e-cigarette say they do so as an aid to giving up in a declining world of adult smokers.

● Cafes and tearooms experienced a 46% increase in the number of net openings between 2016-2017 - the largest number of net openings in that year. This is concurrent with a wider trend over the last decade as the number of coffee shops has increased by 140%. Research shows that 24-35 year olds are the biggest growing consumer demographic among tea drinkers.

● Despite high-profile appearances in the media, restaurants and bars were the fourth fastest growing retail category in 2018. Independent restaurants make up 68% of sales out of the £89.5 billion dining out market. Demand for finance by restaurants has also increased by 100% so far in 2019.

After showing the fastest growing categories, the Recovery Road timeline walks you through the British high street from 2008 to 2018, detailing the appearance and disappearance of some well-known retail stores.

The below graph clearly demonstrates the top five fastest growing retail categories between 2016 to 2018:

For more information about 365 Business Finance and Recovery Road visit their website here.